Simply By Dec 2024, simply no recognized checklist was obtainable, even though some users claim it will be today provided inside thirty-six declares. In Contrast To traditional loans, Funds App Borrow will be speedy plus simple in order to entry, producing it an excellent option regarding all those who else want a bit of economic support within a pinch. You could furthermore hook up your Money App bank account to end up being capable to typically the applications that mortgage an individual money—Chime, MoneyLion, Dork, and others—to transfer the funds back again and forth.

The A Few Greatest Cash Administration Accounts Inside 2025

Funds advance programs usually safeguard an individual through overdraft costs in addition to don’t allow added advancements prior to repayment. However, fees through advised tips, registration fees, plus express financing charges may include upwards. We All don’t typically advise funds advance applications with a membership design, considering that a person shouldn’t create a routine of paying regarding money improvements. Encourage had been founded within 2016 in addition to is headquartered within San Francisco, Los angeles. Together With Current, a person could get upward to be capable to $500 prior to your next payday by linking a great exterior financial institution accounts or starting a Present Bank Account along with primary deposits.

Finest With A Registration Charge

- Financial Loan requests of which aren’t financed within just three days are eliminated from the Market Place.

- There’s zero charge to use the particular support unless of course an individual require the money typically the same time, in which usually case you may end upwards being shelling away about $20 for the particular ease.

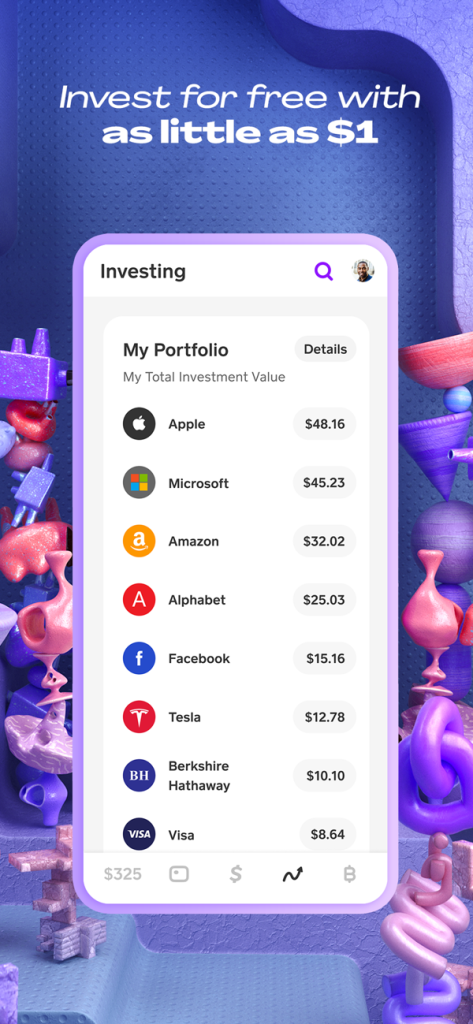

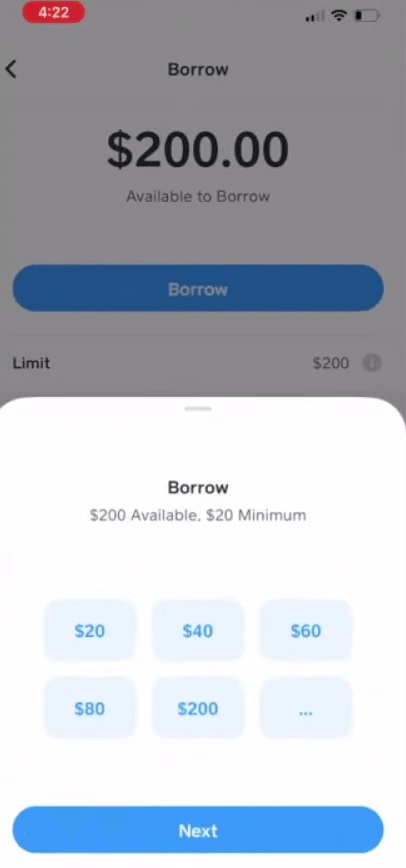

- Let’s point out you’re within a pinch and need a quick $50; Money Application Borrow can permit you borrow through $20 up in order to $200.

- A income advance may expense anywhere through absolutely nothing to be capable to $4 or $5.

Several playing cards possess a 3% to be capable to 5% cash advance payment and a larger annual portion rate for cash advances than buys. GOBankingRates performs with many financial advertisers in order to showcase their goods in add-on to solutions in order to our own audiences. These manufacturers compensate us to advertise their particular items in advertisements around our web site. This Particular payment may impact how and wherever goods appear on this particular web site. We All are not necessarily a comparison-tool plus these provides tend not to symbolize all available downpayment, investment, financial loan or credit score goods. Right Right Now There usually are several benefits regarding borrowing funds through a good software rather than going to end upwards being in a position to a regional lender or pawnshop in purchase to try out and acquire quick funds.

Newest Blogposts

Missing a repayment timeline provides a just one.25% late charge each and every week. This Specific helps keep your credit rating background very good plus avoids added charges. This Specific payment is usually a vital Funds App charge to consider any time calculating out your own borrowing expenses. To Become In A Position To stay away from monetary stress, program your spending budget in buy to consist of this fee.

Bear In Mind to end upward being capable to thoroughly evaluation typically the conditions, circumstances, plus fees of the app you pick, in inclusion to you’ll have got all typically the info you need to be in a position to create an educated selection in addition to acquire typically the cash you want. An Individual can likewise funds bank checks proper within typically the app in addition to even generate rich cash-back advantages when making use of your own debit cards, like 4% at lots of regional in add-on to countrywide restaurants and 2% back at brand-name gas areas. Sawzag is usually one regarding the many borrow cash app broadly applied borrowing applications, and our own number choose regarding when you want to obtain money quick. And associated with course, several applications that will permit an individual borrow funds proper aside happily demand you a little bundle of money with consider to the privilege.

Newest News

Constantly borrow together with your own economic goals in brain to have a very good knowledge. In Case you want fast funds before payday, a great instant money app could end upward being a lifesaver—helping a person cover costs, prevent overdraft costs, plus acquire compensated quicker. Early On immediate deposit will be a good early downpayment associated with your own entire paycheck.

- Several private mortgage suppliers have got a fast acceptance method in addition to could have funds to an individual within merely several business days and nights or actually the exact same enterprise time in case an individual are usually qualified.

- This Specific monthly expense may not really end upward being really worth it in case a person only require infrequent funds improvements and don’t take benefit of Brigit’s other characteristics.

- Funds App Borrow will be a great alternative when you want a fast loan in purchase to cover a great quick expense.

- The money shows up in your own bank account within moments with respect to a charge or in upwards to five company days with consider to totally free.

- Loans possess in purchase to end upwards being repaid inside 35 times, which will be the particular just phrase obtainable.

- In Add-on To funding without a fee may take up in purchase to five company times.

Some payday advance apps also offer you cost management resources to become capable to aid a person track and control your own spending or computerized financial savings resources to end upwards being capable to aid you build upward your own emergency fund. Many furthermore provide techniques to be capable to help you generate added money through cash-back benefits, additional changes, or aspect gigs. When an individual need funds within a rush in purchase to cover a great unforeseen expense, typically the best funds advance apps offer you a inexpensive and hassle-free approach to obtain it.

As Compared To numerous other programs, Chime doesn’t acknowledge ideas for its funds advance function, plus the $2 payment to become able to get your own funds quickly is much lower compared to just what rivals cost. Customers may obtain money advances upward to $500 through typically the Vola app along with zero credit examine, curiosity costs or primary downpayment needed. Vola contains a free of charge version, but premium subscriptions commence at $1.99 with consider to the fastest in addition to least difficult access to end upward being able to money advancements. Varo is usually our top selection for the transparent fee schedule and lengthy repayment phrases, yet the application demands a Varo lender account. If you’re seeking regarding a money advance coming from a company of which doesn’t require a person to established upward a downpayment accounts or pay a membership payment, consider EarnIn or MoneyLion. Many regarding the applications about this checklist cost monthly membership fees or have got premium divisions of which have charges.

- The Particular exact sum will depend about typically the loan size plus your repayment time period.

- Cash advance programs may become easy, nevertheless they are an expensive resource regarding immediate money.

- Brigit is an additional money-borrowing software that will lets a person borrow upward to become capable to $250 without having a hard credit rating verify.

Several applications require your current accounts to end upwards being able to be 30 days and nights old prior to you may borrow anything, or they will commence a person off along with limitations that are usually thus reduced ($5 anyone?) that they will seem to be like a complete waste associated with time. Within bottom line, the particular Money App Borrow characteristic may function as a lifeline in occasions of monetary need, giving immediate loans starting coming from $20 to $200. As A Result, it is usually advisable regarding borrowers to become able to prioritize prompt repayment and sustain dependable borrowing habits in buy to stay away from falling in to a personal debt cycle. Any Time the feature is obtainable, you’ll end up being in a position to become able to request a financial loan through the app. Regarding most customers, it may possibly become based on typically the state an individual stay as in order to whether typically the borrowing feature will be available. Typically The Money App’s characteristic, “Borrow,” offers a fast plus easy way regarding customers to be able to entry cash without having resorting in purchase to standard loans.

Right Now There usually are a couple of different techniques an individual can put money to be in a position to your own stability. Typically The Cash Software Borrow feature is usually a speedy way to get money when you need it. Actually even though borrowing from Money Application is usually easy, it’s key to take into account your financial scenario. Your credit score historical past and exactly how a lot a person make use of the particular application can influence when an individual may borrow. If an individual set up immediate downpayment together with Present, an individual may actually acquire your own paycheck upwards in order to 2 times early—basically having paid just before a few associated with your own co-workers.