What are all the cryptocurrencies

While it is possible to make money mining cryptocurrency, it requires careful consideration, risk management, and research. It also involves investments and risks, such as hardware costs, cryptocurrency price volatility, and cryptocurrency protocol changes https://growseeds.info/. To mitigate these risks, miners often engage in risk management practices while assessing potential costs and benefits.

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

After each transaction is hashed, the hashes are organized into what is called a Merkle tree (also known as a hash tree). A Merkle tree is generated by organizing transaction hashes into pairs and then hashing them.

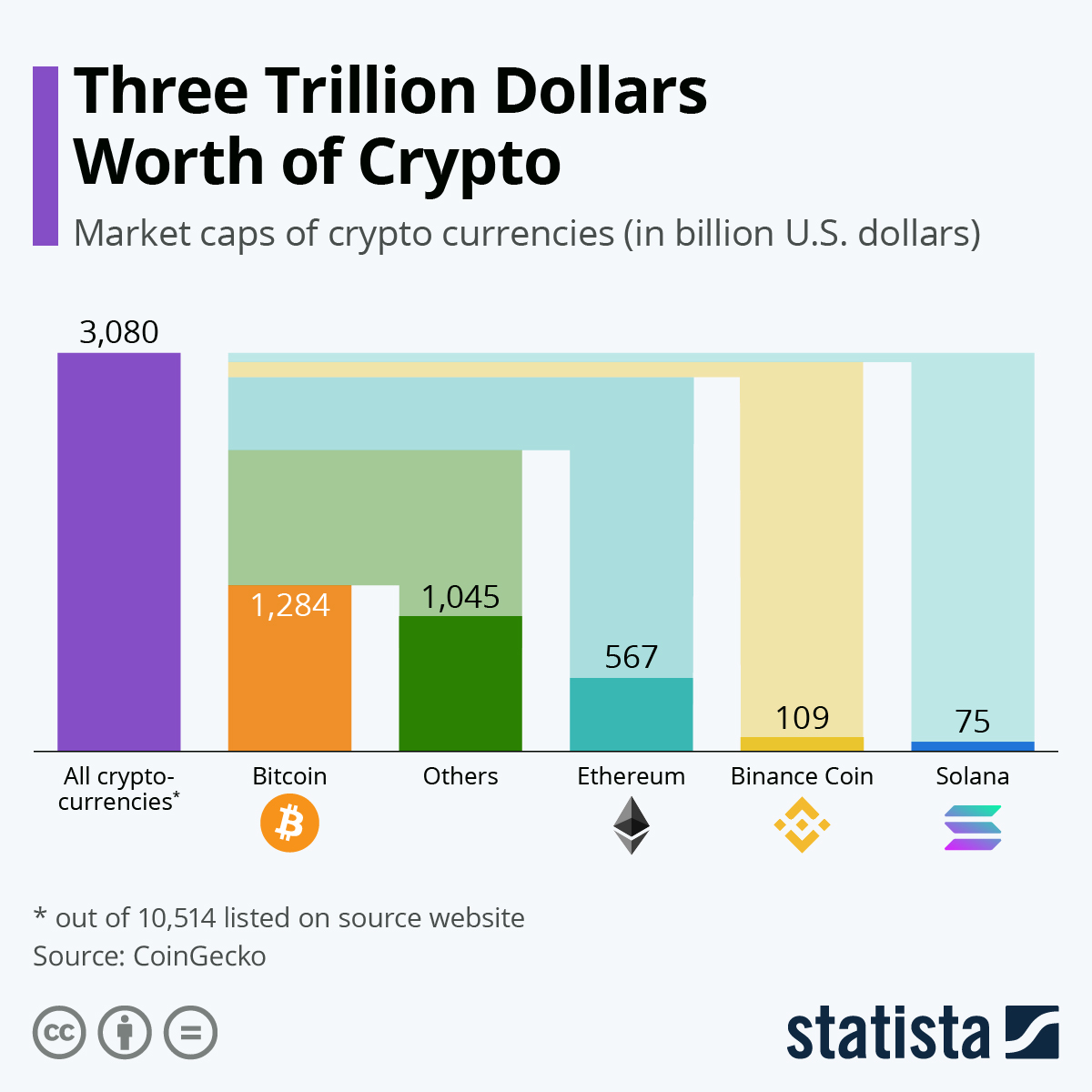

What is the market cap of all cryptocurrencies

Generally, cryptocurrency price data will be more reliable for the most popular cryptocurrencies. Cryptocurrencies such as Bitcoin and Ethereum enjoy high levels of liquidity and trade at similar rates regardless of which specific cryptocurrency exchange you’re looking at. A liquid market has many participants and a lot of trading volume – in practice, this means that your trades will execute quickly and at a predictable price. In an illiquid market, you might have to wait for a while before someone is willing to take the other side of your trade, and the price could even be affected significantly by your order.

Bitcoin is the most popular cryptocurrency and enjoys the most adoption among both individuals and businesses. However, there are many different cryptocurrencies that all have their own advantages or disadvantages.

However, it’s not always the case that big market moves are connected to specific events. Sometimes, the cryptocurrency market moves because of technical factors, such as important support and resistance price levels.

A blockchain is a type of distributed ledger that is useful for recording the transactions and balances of different participants. All transactions are stored in blocks, which are generated periodically and linked together with cryptographic methods. Once a block is added to the blockchain, data contained within it cannot be changed, unless all subsequent blocks are changed as well.

If you want to buy a particular cryptocurrency but don’t know how to do it, CoinCodex is a great resource to help you out. Find the cryptocurrency you’re looking for on CoinCodex and click the “Exchanges” tab. There, you will be able to find a list of all the exchanges where the selected cryptocurrency is traded. Once you find the exchange that suits you best, you can register an account and buy the cryptocurrency there. You can also follow cryptocurrency prices on CoinCodex to spot potential buying opportunities.

When evaluating the crypto market capitalization, it’s important to have a historical perspective of how the size of the cryptocurrency market has changed over time. We provide historical crypto market cap data showing the total crypto market cap at the end of each year since 2013.

Are all cryptocurrencies based on blockchain

In Bitcoin, your transaction is sent to a memory pool, where it is stored and queued until a miner picks it up. Once it is entered into a block and the block fills up with transactions, it is closed, and the mining begins.

Transactions on the blockchain network are approved by thousands of computers and devices. This removes almost all people from the verification process, resulting in less human error and an accurate record of information. Even if a computer on the network were to make a computational mistake, the error would only be made to one copy of the blockchain and not be accepted by the rest of the network.

On some blockchains, transactions can be completed and considered secure in minutes. This is particularly useful for cross-border trades, which usually take much longer because of time zone issues and the fact that all parties must confirm payment processing.

Proving property ownership can be nearly impossible in war-torn countries or areas with little to no government or financial infrastructure and no Recorder’s Office. If a group of people living in such an area can leverage blockchain, then transparent and clear timelines of property ownership could be maintained.

Blockchain technology achieves decentralized security and trust in several ways. To begin, new blocks are always stored linearly and chronologically. That is, they are always added to the “end” of the blockchain. After a block has been added to the end of the blockchain, previous blocks cannot be altered.